By David S. Bunton

President, The Appraisal Foundation

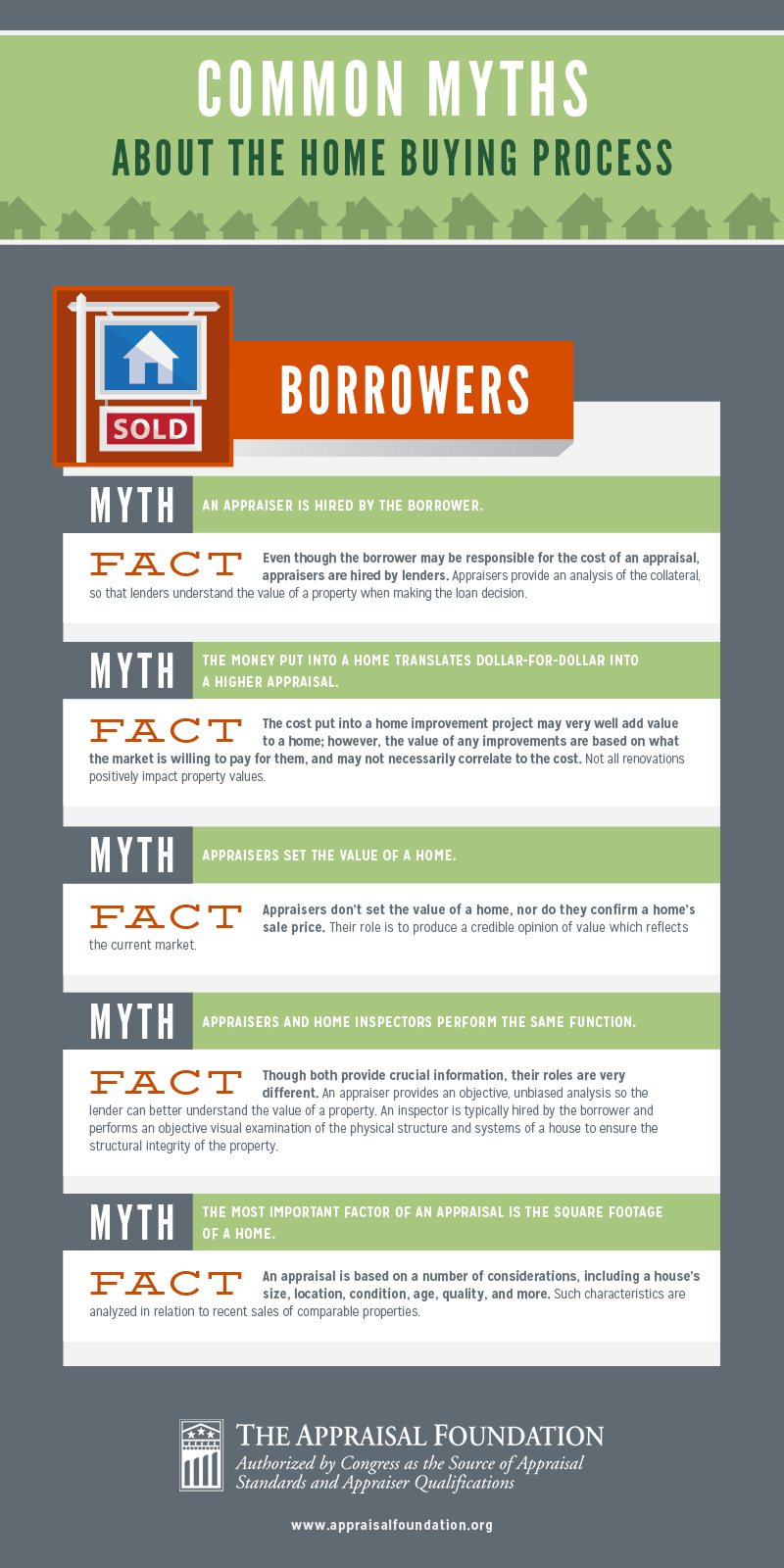

In today’s increasingly competitive real estate market, understanding the appraisal process cannot be overstated. Appraisals are required for all real estate transactions with loans involving $250,000 or more from federally-insured financial institutions, which impacts millions of Americans. Although appraisals are one of the most important parts of the home buying process, they are often one of the most misunderstood.

Contrary to some beliefs, appraisers neither set the value of a home nor confirm a home’s sale price. Their role is to produce a credible opinion of value based on thorough and unbiased research and analyses that reflect the market value of a property, which is not always the sale price. In many cases, an appraisal may help prevent a buyer from overpaying for a home. That’s why it’s so important to understand how an appraisal works and what they’re intended to do.

We at The Appraisal Foundation hear a lot of myths about the appraisal process — from people who are new to the home-buying process and from those who work in real estate professionally — but the most common myths out there relate to the way appraisals are ordered, the role appraisers play in the home-buying process, and the ways in which properties are analyzed and reviewed.

For most people, purchasing a home is the most important financial decision they will ever make. Having a firm grasp of the process is critical to remaining informed and making sound financial decisions.

- Polley Associates is approved by The Appraisal Foundation as a provider of education for both the 15-hour and 7-hour editions of the “Uniform Standards of Professional Appraisal Practice” courses. We are re-publishing this article by foundation President David S. Bunton, and the accompanying infographic that appeared March 12 (2014) in The Huffington Post blog, as a service to our appraisal students and the public.

- See all Polley appraisal certification (licensing) courses here.

- See Polley appraisal recertification (continuing education) courses here.

Polley Associates is Pennsylvania’s oldest and largest “approved provider” school for real estate career professionals. It also meets the needs of licensees in New Jersey, New York and Delaware.